Make sure your minimum wage posters are up to date – click here to download.

On March 2, 2016 the Oregon Governor signed into law Senate Bill 1532 which raises Oregon’s minimum wage beginning July 1, followed by annual increases over six years. A unique feature of the new law is there will now be three minimum wages for Oregon employers, depending on the population density of the area where a business operates. The largest increase will be in Portland and the surrounding areas. In 2022 the minimum wage there will rise to $14.75 per hour. Mid-sized counties will see an increase over six years to $13.50 and in more rural areas the minimum wage will increase to $12.50 per hour.

Oregon’s geographically tiered system was designed to address concerns among some economists that employers in rural areas could struggle with a wage increase to nearly $15 per hour and possibly result in job loses rather than having the intended goal of paying living wages to Oregon employees.

With one large minimum wage increase at either the state or federal level it was believed that any resulting job loses would not be evenly distributed and would instead cluster in areas where the economy may not be strong enough to support paying low-wage workers more per hour. Oregon’s approach to structuring the increases regionally rather than statewide is an attempt to avoid this outcome.

The federal minimum wage was increased to $7.25 per hour in 2009. Oregon’s minimum wage is currently $9.25 per hour and typically sees annual cost of living increases.

The new Oregon minimum wage will start phasing-in on July 1, 2016 based on where the employee works, and will increase annually thereafter according to the following schedule:

Tier 1 (the Portland metro area & urban growth boundary which includes all of Multnomah County and portions of Washington and Clackamas counties):

July 1, 2016: $9.75

July 1, 2017: $11.25 (a $1.50 per hour increase and the largest under the new law)

July 1, 2018: $12

July 1, 2019: $12.50

July 1, 2020: $13.25

July 1, 2021: $14

July 1, 2022: $14.75

Tier 2 (Benton, Clackamas, Clatsop, Columbia, Deschutes, Hood River, Jackson, Josephine, Lane, Lincoln, Linn, Marion, Multnomah, Polk, Tillamook, Wasco, Washington and Yamhill counties):

July 1, 2016: $9.75

July 1, 2017: $10.25

July 1, 2018: $10.75

July 1, 2019: $11.25

July 1, 2020: $12

July 1, 2021: $12.75

July 1, 2022: $13.50

Tier 3 (Malheur, Lake, Harney, Wheeler, Sherman, Gilliam, Wallowa, Grant, Jefferson, Baker, Union, Crook, Klamath, Douglas, Coos, Curry, Umatilla and Morrow counties)

July 1, 2016: $9.50

July 1, 2017: $10

July 1, 2018: $10.50

July 1, 2019: $11

July 1, 2020: $11.50

July 1, 2021: $12

July 1, 2022: $12.50

After 2022 minimum wages will then be adjusted according to the state’s cost of living. A new minimum wage poster is being created that must be displayed in all workplaces. Watch this space for when it becomes available, along with a link to download and print the new poster.

If Oregon’s tiered minimum wage approach works it may become a model for other states considering a large minimum wage increase. On April 4th the governors of California and New York each signed legislation increasing their statewide minimum wage to $15 per hour by 2022.

Several cities, including San Francisco, Seattle and New York have already significantly increased the minimum wage for workers. Currently, over 125 cities and counties around the U.S. have living wage ordinances requiring a minimum living wage be paid to any employee performing work either for or within their jurisdiction.

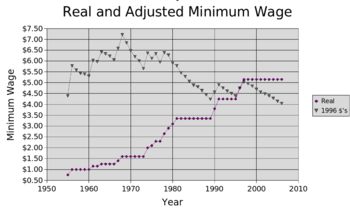

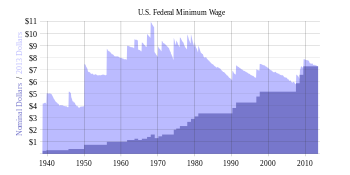

English: This is a history of minimum wage increases under the 1938 act. This is current as of September 2009, with the inflation adjustment going to August 2009, the latest data. (Photo credit: Wikipedia)

Important Update:

Two weeks before the July 1st effective date BOLI provided guidance for employers with minimum wage employees who provide services in multiple Oregon geographic regions during any given pay period. The new guidance provides three key rules for employers:

1. If an employee performs more than 50% of his/her work during a pay period at a fixed business location, the minimum wage rate for the region encompassing that business location applies to all hours worked during the pay period.

2. Delivery workers who start and end their work at the same fixed business location should be paid at least the minimum wage rate for the region encompassing that business location, notwithstanding deliveries made outside that region.

3. For those employees who do not perform more than 50% of their work during a pay period at a fixed business location, the employer must either:

(a) Track and maintain a record of where the employee performs his/her work and pay at least the applicable wage rate for each region where the work was performed, or

(b) For all hours worked during the pay period, pay the highest wage rate required for any region in which the employee worked.

Employers should review their payroll practices, evaluate the options above for any employees working in more than one of the defined regions and implement changes to comply with the requirement.

Holloway HR Consulting specializes in HR compliance, employee relations, organizational development and crafting progressive solutions to address the continuously evolving challenges facing small and mid-sized companies. Please contact us with any questions.